All Categories

Featured

After signing up, each prospective buyer will certainly receive a bidding number from the Auction Internet site that will enable the prospective buyer to place quotes. All bidders must make a down payment on the Auction Site prior to their proposals will be approved. Each prospective buyer shall make a down payment equal to 10 percent (10%) of the total dollar amount of tax obligation liens the prospective buyer anticipates winning.

Tax obligation liens are awarded to the highest prospective buyer, or in case of a tie, the victor will certainly be selected randomly by the Auction Website, and the winning proposal amount will certainly equate to the amount of the tie proposal. Tax liens will certainly be grouped right into sets and offered in one-hour increments beginning on November 6, 2024, at 8:00 a.m.

The City and Area of Denver will certainly keep the certificates if the purchaser wishes and offer duplicates. Redemption interest is 15% per year. If parcels are redeemed prior to delivery of certificates, redemption checks will certainly be mailed to customers and symbols made on buyers' checklists of purchases. Workers and authorities of the City and Area of Denver, and participants of their households are not permitted to purchase at the Public Public auction.

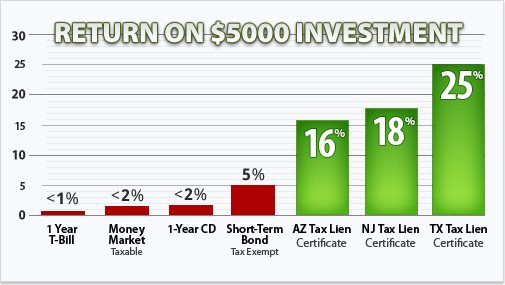

Is Tax Lien Investing Profitable

There are no warranties revealed or indicated relating to whether a tax lien will show to be a rewarding investment. The residential property information available on the quote pages was gotten from the Assessor's office before the start of the current auction and is for reference just (please note that this property information, offered by the Assessor's workplace, stands for the most present analysis year, not the tax year connected with this tax obligation lien sale, as taxes are paid one year behind).

Latest Posts

Delinquent Tax Properties Near Me

Free Tax Lien Property List

Back Taxes Owed On Homes