All Categories

Featured

Table of Contents

And they are most likely to have the economic skill to comprehend a risky financial investment chance, even with limited information.

The Stocks Act requires that all offers and sales of protections must either be signed up with the SEC or drop within an exemption from enrollment - institutional accredited investor. The meaning of certified financier in Regulation D of the Stocks Act sets forth multiple groups of exemptions intended to show that certifying capitalists have enough economic elegance such that the Securities Act's enrollment procedure and related defenses are unnecessary

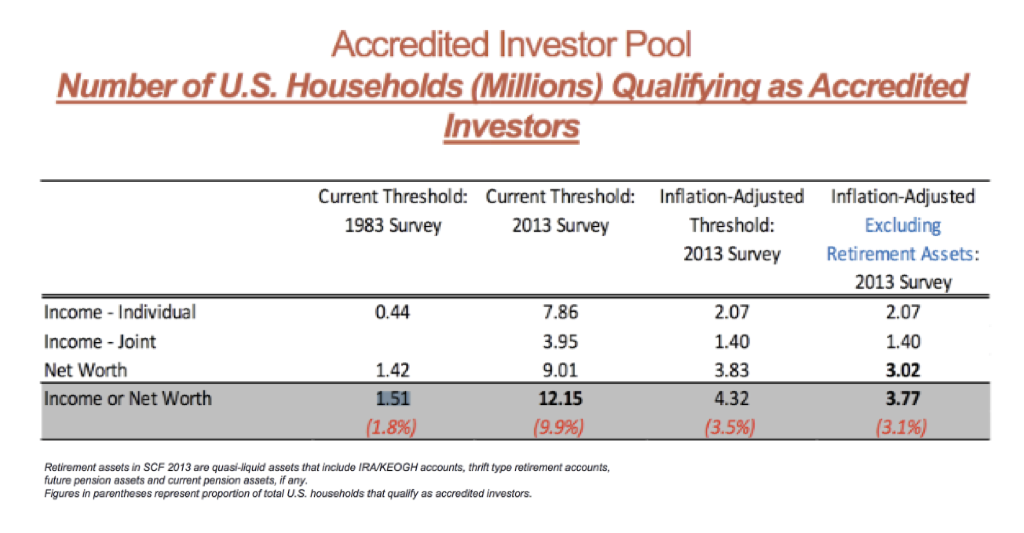

Based primarily on an evaluation of filings made about Policy D exemptions, the personnel record supplies data on the variety of U.S. houses that satisfy the definition of recognized financier and examines whether current securities market methods are supplying sufficient financier protection. The report mentions that 1,510,000 families (or 1.8% of all United state

households) by 2022. The substantial increase is connected largely to the reality that revenue and total assets thresholds under the meaning have actually not been adapted to show rising cost of living, increasing worries that rising cost of living and other monetary elements are blowing up the accredited investor swimming pool while financiers may not be as advanced as their big properties would certainly seem to reflect.

It helps guarantee that those diving into complicated investments have the required resources and knowledge to manage them properly. Make the effort to explore this designationit can be your gateway to smarter, much more diversified investing. Certified investor status is specified by the SEC as an individual or entity with the financial stability and elegance to purchase non listed safety and securities investments, and can be obtained by meeting earnings, web worth or professional criteria.

Accredited Investor Leads Oil Gas

Table of Contents The Securities and Exchange Commission (SEC) specifies a certified capitalist as a specific or entity able to join financial investments not registered with the SEC, usually scheduled for high-net-worth people or entities. This term, coined under Law D of the Stocks Act of 1933, is designed to ensure that only experienced investors with ample resources buy these offerings.

Just how do you come to be a certified investor? Coming to be a certified investor is not just regarding having a high revenue or huge quantity of wide range.

If the number fulfills the above thresholds, you're considered a certified capitalist. Entities like banks, collaborations, companies, not-for-profit companies, and trusts can likewise qualify as certified investors, provided they satisfy property limits or all equity owners are approved capitalists themselves.

There have been recommendations to add an experience need to these financial credentials, suggesting the evolving nature of the accredited financier policies. In addition, a person who holds a placement like a basic collaboration, executive officer, or supervisor in the releasing business certifies as a recognized capitalist, more broadening the meaning.

The accredited capitalist status is normally valid for one year or till the next tax day if verified through income. Note there is no government verification procedure, so it's up to the investment supplier to execute private verifications of income and total assets. Being an approved investor includes legal commitments and ramifications.

It requires satisfying certain monetary limits or showing financial class. While it provides the potential for higher returns and more diverse financial investments, it can bring greater dangers. It's vital to consider elements thoroughly, as every person's personal financial situation and needs are different. An approved financier is typically a high-net-worth person or entity with substantial earnings and web well worth, as detailed in Regulation 501 of Law D.

Accredited Investor 401k

Although these investments often tend to be riskier and much more illiquid, these asset classes can offer advantages such as higher diversity from public markets, potentially higher returns, and exposure to industries or markets that aren't offered in the United States. Most capitalists are only able to purchase those that are openly listed and registered with the SEC.Based on your income or total web well worth, however, there's a chance you could receive an investor status that can open up extra monetary possibilities.

See if you certify. In this post, we unbox these capitalist conditions for tax obligation payers in the United States and clarify what they can get accessibility to. Arta is available today to United States Accredited Investors and above, but our goal is to make a "digital household office" readily available to more people gradually.

For a growing number of investors that certify as an accredited financier, financial investment choices expand substantially. These financial investments are indicated to be exempt from SEC registration, so there is no main process for validating condition. Each firm has its own method for verifying accreditation and it's normally a variant of giving individual details and documentation.

We look onward to bringing the wealth-building chances that were generally available to the ultra-wealthy to many even more people. With this very first step, we're functioning to make Arta available to extra financier types and countries in the future. If you want accessibility to wealth-building opportunities like exclusive investments, you can begin by ending up being an Arta member today.

Real Estate Investing For Accredited Investors

Please call us if you have concerns concerning the new meanings of "certified investor" or "qualified institutional purchaser" or any type of various other private or public safeties issues. The modifications are anticipated to become efficient by the beginning of November 2020.

Any type of monetary projections or returns revealed on the internet site are approximated predictions of efficiency only, are theoretical, are not based upon real financial investment results and are not assurances of future outcomes. Estimated forecasts do not stand for or assure the actual outcomes of any type of deal, and no depiction is made that any type of transaction will, or is likely to, attain outcomes or profits similar to those revealed.

Investor Test

Any kind of financial investment information included here has actually been secured from resources that Yieldstreet thinks are dependable, but we make no depictions or guarantees as to the precision of such information and approve no liability. Private placement financial investments are NOT financial institution down payments (and thus NOT insured by the FDIC or by any type of various other federal governmental firm), are NOT ensured by Yieldstreet or any kind of various other party, and MAY decline.

Investors have to be able to manage the loss of their entire investment. Investments in personal placements are speculative and include a high level of threat and those investors that can not pay for to lose their whole financial investment ought to not spend. Additionally, capitalists might get illiquid and/or restricted safety and securities that might be subject to holding period needs and/or liquidity worries.

Buying safeties (the "Securities") noted on Yieldstreet position dangers, consisting of however not limited to debt danger, rates of interest risk, and the threat of shedding some or all of the cash you spend. Before investing you ought to: (1) perform your own investigation and analysis; (2) very carefully take into consideration the investment and all relevant fees, expenditures, unpredictabilities and dangers, consisting of all uncertainties and risks described in providing materials; and (3) speak with your very own financial investment, tax obligation, economic and legal consultants.

Real Estate Investor Qualifications

Spending in personal placements needs long-lasting dedications, the capability to manage to lose the whole financial investment, and reduced liquidity demands. This web site does not constitute an offer to market or get any type of safety and securities.

Yieldstreet does not make any kind of depiction or warranty to any type of prospective investor pertaining to the legality of a financial investment in any Yieldstreet Stocks. YieldStreet Inc. is the straight owner of Yieldstreet Management, LLC, which is an SEC-registered financial investment adviser that handles the Yieldstreet funds and supplies investment suggestions to the Yieldstreet funds, and in certain instances, to retail capitalists.

We after that use one more firm to send out special deals via the mail on our part (hedge fund accredited investor rule). Our company never gets or stores any one of this details and our 3rd parties do not provide or sell this info to any kind of other company or service

Latest Posts

Delinquent Tax Properties Near Me

Free Tax Lien Property List

Back Taxes Owed On Homes